Recently, I noticed something about my Robinhood account–I had $54 that wasn’t being invested! Its like the episode of Seinfeld where Jerry intentionally loses $20, only to find a $20 in his jacket from last spring.

This is my review of Erdinger Heffeweizen.

Not my kitchen

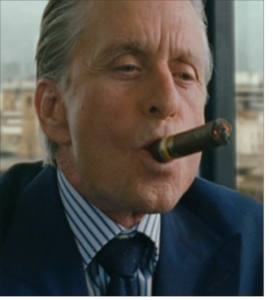

Some of you may not know what Robinhood is–its a stock trading app that lets you trade certain stocks, options, and cryptocurrency on their platform. They cannot trade everything, and unless you have an account valued over $25,000 they will not allow you to day trade, but they let the user make trades for free. Its popular with Millennials that want to ruin everything. The app makes money by putting the user’s un-invested balance towards their own securities the proceeds of which they will collect, a common practice among low cost trading platforms. I have a few investments that is money I didn’t spend that I would rather accrue value instead of sitting in a checking account. It serves mostly as a form of entertainment; my retirement is handled by paid professional, cigar chomping assholes. Since I began investing about 18 months ago I have a 19%ROI but that may level off at some point.

Speculating on Bitcoin is very much out of the price range of many but there are others to look at. Quite frankly I am no expert but other Glibs such as Richard and SUPREME OVERLORD trshmnstr did the deep dive here, here, and here.

“Paid Professionals”

Recently, Facebook got in on the action by creating their own version of cryptocurrency, Libra, meant to assist people in countries that have difficulty accessing banks. This strikes me as odd, because if somebody lives in a country so poor that finding a bank to store money and process transactions for personal business is problematic, how is it that person has access to the internet with strong enough signal to process such a transaction? Then there is this….

While true public blockchains are much more decentralized than permissioned blockchains, they also tend to have lower transactions volumes. Bitcoin processes about seven transactions per second, compared to the 1,000 transactions Libra expects to need for its users. Which leads to another difference between Libra and more traditional public blockchains: It has to accommodate Facebook’s 2.7 billion users, as well as the users of the other 27 association members.

Among the public blockchain features being designed into Libra, the transactions won’t have names but will instead rely on a string of numbers and letters that will be visible to the general public. Which means that while the identities of the transactions might be known to the manufacturers of some wallets in which users store their libra coins, the public can see only the public key— or address—owned by each transaction counterparty.

While Facebook’s new cryptocurrency wallet subsidiary, Calibra, will require users to go through an intensive anti-money-laundering (AML), know-your-customer (KYC) process, and will be reporting suspicious activity to the authorities, other wallet providers are not required to do so. Given concerns about how Facebook monetizes its users personal data, the company promises not to mingle transaction data collected by Calibra with Facebook’s user data.

I totally believe that last little bit.

There’s also the part where a ‘Facebook Sanctioned” currency sounds an awful lot like mining companies that once paid their employees in tokens that can be used at the company store… Then there is the part where Facebook is the central authority in the use of this currency. I thought the point of cryptocurrency was a decentralized currency with value derived from Adam Smith’s invisible hand, rather than a cabal at a central bank.

I decided to keep it modest. I will simply dabble in speculating with speculating cryptocurrencies while I check out patters on one that might actually be worth investing in. So for now, I own 12,195 Dogecoin. No I am not joking, but the currency began from what is essentially a joke.

Erdinger like every other beer made in Germany is fully compliant with the Reinheitsgebot. This is the beer purity law that has been in effect since the 1500s. It might be the only practical argument for a successful attempt at centralized control of industry, but I’m not about to entertain that given that I can make perfectly safe beer in my closet. This is made in the traditional German style with the slight citrus bite, and heavy dose of banana. Highly recommended at the German place in my neighborhood that has it on tap. Erdinger Hefeweizen 3.2/5

So the other beers at the German place must be crap if they’re not even a 3.2/5?

I’m going to say something controversial. Lets consider everything we know about German: cars, porn, political theory, cameras, music (David Hasselhoff), that weird magazine release, solar powered ECU modules…

Is is really better or is just “German?” Apply your answer to their beer.

Of course, I have no idea how long thats been sitting in the keg.

I think it depends on the thing. For beer and high end cars, they really are better. For everything else, it’s just German.

Perhaps one of these days I’ll tell you all the story about the Merc I was driving had a radiator hose break on me while I was driving it in August.

Mercenary? Mercury? Mercatur?

Their industrial machines (lasers, press brakes, turret punches) are also top of the line (see: Trumpf).

And their bier.

What my NoDak friend said.

Yes, Kruat machinery is top notch, mostly. I’m only familiar with older stuff, though.

Until you miss one iota of expensive, convoluted maintenance, at which point it becomes a brick.

Amazingly enough, the maintenance on the Trumpf lasers I’ve been around is relatively inexpensive and usually quite easy to do.

Fewer moving parts?

You know, I guess there isn’t really a lot of moving parts in a laser. Less than a car, I would think. There’s highly precise moving parts, but not a lot of them.

However, there’s (understandably) a metric shit-ton of electronics.

Or two and a fifth Imperial Shittons of electronics.

That’s why you should keep meticulous records of each maintenance procedure performed and precisely how much oil was used and what (if any) wear was observed, not to mention the ambient temps of the room when said service was performed.

“Ahh, you used one cubic milimeter too much lubricant, which produced ze incorrect amount of cooling. Zis voids your warranty.”

“I think it depends on the thing. For beer and high end cars, they really are better. For everything else, it’s just German.”

Doesn’t matter, in 10 years or less, Germany’s car industry and everything else will be completely destroyed by Merkel and her merry band of lesbian socialists.

Their beer laws survived Hitler. They will also survive Merkel.

True, but since the EU became a big thing post Cold War many smaller breweries have either went out of business or consolidated. There is better overall customer selection, but smaller numbers of available local beers.

What I miss each time I leave Germany are their bier shops. Big selections out on the floor of all their offerings. A 1/2 liter bier runs around 80 Euro cents and you can by a crate or miss and match. They charge a deposit (pfand) but that store must take back bottles for any beer they offer in the store. Bring in your empties, the machine by the front door sorts them and gives you a ticket. Use the ticket for the next crate of beer.

There was something to the craft culture: a society built on rules, dedication, competence, and execution was the best way to do things pre-war world-wide.

Post-war, there was no consistent proof that their products were any better than France’s. Lots of inspection, lots of filing, still essentially post-war. In the US, the new thing was being rejected as well.

Now, finally, circa 2010, German cars are as good as Japanese: the simple plan of designing quality into a design and process instead of relying on craftsmanship has finally caught on . . . even later than in the US.

I could pretty much have anything, but we just bought another Japanese car, a made-in-Japan Japanese car.

My condo smells like a forest fire from all the smoke that drifted up from a 60k acre fire on the Kenai. I don’t mind it since it made for an apocalyptic scene this morning when the sun rose.

I haven’t looked at my investments lately, but 18% sounds pretty good for a one-year return. It’s going to slow down at some point, but I’m *does the depressing math* a long way from worrying about it.

Some of you may not know what Robinhood is…

No, no I didn’t. Thanks for the intro. Back in the day I loved Sharebuilder, but they charge a monthly fee.

Mmmm. Hefeweizen.

Love it better than all beers. My fave is Franziskaner on tap in Aachen can’t be beat.

#metoo

I knew I liked you. My fave is Weihenstephaner. My second favorite is all the rest of them.

Funny you should mention that!! Had my first Weihenstephaner just last week and actually got a little aroused, lol.

Very tasty.

I am a dunkelweissen fan. Hefe is goooooood bier, but that little bit more with a dunkel is wunderbar. I lived in Bavaria for three years and go back to visit often since my son and his family live there. I miss the hundreds of small breweries all over the country. There were some seriously fantastic beers to be found in small towns everywhere.

Hef is the white people of beer.

Heil!

Well.. I am a white person. Don’t other me.

Yeah, I can’t dance either.

Hefeweisen is the best. I enjoy the German imports but, so far, nothing compares to what you get out of the tap in Germany.

You know, I think we could be buddies. Every weekend we could get together and sit around drinking hefe, listening to kick ass rock music. I’ll start looking for a nice place in North Dakota for you.

My dude. I am with you right up to the NoDak part. It’s a little light on (((my))) people and, I suspect, not vegetarian friendly.

The deer you eat were vegetarians, isn’t that close enough?

*Scratches head. Reads Beyond Burger ingredients. Blinks twice*

No. No it’s not.

Wait…you’re one of (((them)))?

Uh, yeah…I just looked and there is no houses for sale in NoDak. Sorry bud.

?

“Mmmm. Hefeweizen.”

Ayinger is good. If you’re ever in the upper midwest, try stopping at Frankenmuth Brewery in Michigan. Best Heffe on tap I’ve ever had.

Needz moar Top Men.

Well, that was interesting. Brief power outage does not bode well for the rest of the summer. What is this, California?!

We have had wave after wave of awful storms lately which resulted in half of a dozen outages. A couple of hours we can stand but one day it lasted 12 hours in terrible heat. Yeah, I can do without that.

If we ever get some real heat this summer it is going to be bad. PGE is openly telling customers to prepare for as much as 5 days without power if they shut down a line for safety reasons.

You know what socialists used for light before candles?

Electricity?

People?

It’s only 96 F again today here in the tundra of Balmer. Could snow if it gets any colder.

A crisp 88 here. Being near the ocean does have its occasional benefit.

I started an M1 Finance account. No fees, and you can own partial shares so you can play around with hundreds instead of thousands.

Interesting . . I’ve been meaning to lookinto something like this. I don’t have a lot of spare cash, but I’d like to at least dabble and get started.

Sounds cool.

Brief power outage does not bode well for the rest of the summer. What is this, California?!

Your lack of faith in the will of the collective has been noted, Comrade.

I have complete faith in Cuomo’s will to cause more power outages.

How is this being received in NY? It seems like some supply shortages are looming. Does anyone care or is it like CA where good thoughts are all important up until the shit hits the fan?

Completely ignored by everyone except The Post.

I’m not surprised. I’m disappointed but not surprised. After Indian Point is shut down I will enjoy the schadenfreude when the polar vortex comes through and people are shocked (shocked I say) when they can’t adequately heat their homes because there isn’t enough natural gas.

Well, out here on the left (ist) coast, they allowed a public ultility to get sued for starting a wildfire. The ute then demanded rate increases to pay for it all, but were denied. So now, they decided to preemptorily shut off power whenever they feel like it. They haven’t hit my house yet, but they’ve flipped the switch on abunch of folks. It’s specifically to punish ratepayers for suing them and not covering it through rate increases. Fucked up.

Well that’s just crazy talk.

I presume that cunnilingus is part of the deal.

What a bunch of cunts.

Well that went south fast.

It was kind of bush league.

It could be a hairy situation.

They’re a bunch of pussies.

Well, tongues will waggle.

I was gonna wax poetic, but instead, I’ll just clam up. Except to say: If I had a nickle for every time I’ve heard that first line…

They know when they’re licked.

Can we get all sports teams not to visit the fucking White House or take funds from taxpayers? Pretty please with sugar on top?

For those still relatively new to investing (and even those that aren’t), I will once again strongly recommend Bogleheads and a simple Three Fund Portfolio.

Over 5 years, 82% of actively-managed funds under-performed the S&P500. All of those funds are run by full-time professionals. You aren’t going to outperform them. Your broker isn’t going to outperform them. Not in the long term. Not even in the medium-term. _Maybe_ in the short term. But it’s a gamble.

Reversion to the mean is real.

Anywho, learn from my errors.

Eh, I just mostly leave my 401k alone and let Vanguard and fate deal with it.

I’ll probably not live long enough to enjoy it anyway

I’ll probably not live long enough to enjoy it anyway

Now that’s the kind of retirement plan I can adhere to!

Jack Bogle started Vanguard, so you’re already in good hands. Just watch the fund expenses and you will indeed be fine.

I’ll also note there are a lot of people who assumed they’d die before they’d get a chance to enjoy the money – the Bogleheads boards are filled with stories.

Worst thing that happens is you have more money then you need, so you can cause some mischief with it when the end is clearly nigh.

Same with Vanguard for my 401k. I transfer money every paycheck and rarely bother to look at it.

I figured I’d be largely preaching to the choir here.

Hallelujah!

I have a sound policy for you to manage your 401k by . . . do the opposite of whatever I do.

/ BLC opens Schwab website. Sees funds making double digit returns while he’s only getting 2-3%. Switches money around. Checks again two months later. New funds lost money while the old funds made 7-10% . . . every single time.

Really, just pick the opposite of me and you’ll be all set.

I’m the epitome of buy high, sell low.

You’re Bob!

The Costanza method of success.

Yeah, that would be me, too. Transferred all of my investments into a stock-heavy one about a month before the 1987 crash. Repeat just before the 1990 crash.

The best? I bought gold at $1500.

I intentionally skipped bitcoin because my brother liked it. He’s lost money on every single thing he’s ever even looked at. There’s an ATM for bitcoing at the gas station by my work. I just transferred there in October of last year and it was 2400.00 per then. Mentioned it to my brother and he enthusiastically suggested I buy one, so I didn’t. Now, it’s 12.5 and climbing around 400-500 a day.

Through my employer I’m get a free trial of vanguard actively managing my portfolio. We will see if they can beat my 3 index fund investing strategy.

If you’re already comfortable w/ a 3-fund portfolio, I have to think that’s unlikely. Their 0.3% fee is low for an advisor, but still higher than zero (I assume it’ll go to the 0.3% after your free period is up).

You are correct. I’ll probably cancel before the fee starts

Basically the same thing I learned 30 years ago from reading The Only Investment Guide You’ll Ever Need by Andrew Tobias.

Three funds is not diversified at all… Probably pretty low cost, depending on the fund, though. (But, in keeping, may also not keep pace with inflation, either… )

The company where I work has a ~8.9% average return (GIPS standard, so that’s after we get paid, too) on our portfolios.

But something is still better than nothing.

Depends on the funds – total market + total internal market + total bond market (in some proportion) is quite diversified. People can, and do, argue for adding other things like REITs at the cost of complicating things a bit.

What timeframe is that over for those returns?

Annual returns.

Most of our clients are retired, too. … But we’ve probably only got two accounts that are solely mutual funds. (~260 clients, ~540 accounts, hoping to hit $160m aum by year’s end.)

I have several individual equities and ETFs, only a couple mutual funds, and one REIT in my combined portfolio.

Do you deal with sector analysis at all or nah?

Nope, I’m trying to keep it as simple as possible – I’m comfortable with total market coverage and keeping it low-maintenance, with a long timeframe (I’m not going to for FIRE, sadly, at this point).

I still have work to do – still individual equities left over from various misadventures with guys like Personal Capital, plus lots of company stock, but I (think) I have my ideal portfolio worked out at this point, between my 401k, rollover IRA & taxable accounts.

Next task is, I think, to get that rollover into my 401k so I can start doing backdoor Roths.

Financial euphemisms FTW!

Lol!

Sounds to me like you’re informed enough to know what you’re about, slumbrew.

I do it a little differently, but when it’s my job, I guess I have the time to get complicated.

To be clear, I’m not denigrating advisors – it sounds like you guys are doing well by your clients, though there are plenty of bad-to-borderline-criminal advisors out there.

However, it feels great to have a clear grasp on everything that’s going on plus I spent years paying other people and not once did anyone say anything like “hey, you should move that old rollover IRA into your current 401k so you can do a back-door Roth every year”.

Nah, I didnt think you were at all. And you’re right–there are a lot of bad actors out there, so it’s smart of you to do some of your own research.

I’m very grateful to Jack Bogle. I read one of his books 20+ years ago when I started saving for retirement. He totally sold me on index funds and dollar cost averaging. To anyone who thinks they can’t do it, yes you can. I started by contributing $50 per paycheck. It was all I could afford since I was hip deep in student debt.

Every time I got a raise, half went to an increased contribution and half I kept. Sooner than I realized I was maxed out on annual contributions. It was relatively painless.

It is never too soon or too late to start. Do it even if you you think what you have won’t make a difference. You’ll form a good habit and build momentum over time.

Amen. Never too late, never too little.

“For those still relatively new to investing (and even those that aren’t), I will once again strongly recommend Bogleheads and a simple Three Fund Portfolio.”

Unfortunately, at my age, I’m just too old to gamble with my savings. That’s going to buy me a retirement home, so I can actually retire before I drop dead at my desk.

‘Holy s***! Look at this thing!’ Fisherman films encounter with great white shark

Massive 13-foot shark spotted alarmingly close to Florida beach

I’ve noticed these kinds of articles popping up all of the sudden. After that poor girl died the other day, I think we may be one attack away from another Summer of Shark.

It would be epic if sharks took out an American on the coast of Dominican Republic.

Global Warming! Overcrowding!! Orangemanbad!!

That would be proof we live in the best time line.

“We should totally fuck around with this giant apex predator”

Things went fine in that mov- oh wait a minute. Never mind.

Meh. Shark attacks are strictly local news in Hawaii. If you visit Mauai be careful during the Tiger Shark breeding season. One of the popular resort areas has a breeding area right offshore.

“I’ve noticed these kinds of articles popping up all of the sudden. After that poor girl died the other day, I think we may be one attack away from another Summer of Shark.”

Recife Brazil, where wife and I own a home. Walk down Boa Viagen beach. There are signs about every 100 yards warning about great whites and going out at high tide. People do it, and then are never seen again. Great Whites the size of school buses, *shiver*. One of the top 10 worst areas in the world for shark attacks. You don’t get bitten there, you get eaten whole.

Watch out for crypto snobs coming out of the woodwork arguing why Bitcoin is the worst/best

Bitcoin is the worst/best.

Wrong! It’s the best/worst!

Wurst?

Padlocks?

Megan Rapinoe-

Eek! I played college football with guys who looked more feminine than she does.

So you played for Michigan?

HA!

#sickburn

“Eek! I played college football with guys who looked more feminine than she does.”

She’ll be a political star soon in the democrat party. The left loves them some fugly butch dykes. Obama would have made her sec state or something.

When we bought our house seven years ago we tapped out all the money we had and then some for the down payment and repairs. About five years ago I started a self directed investment account at one of the online trading platforms and at the same time opened a Betterment account. We put some money each month into each of these and it’s had about the same return. If you really don’t want to bother with investing on your own I’d recommend Betterment. You set up single deposits or deposits at certain intervals and set your level of risk and they do the rest. Any dividends are automatically reinvested, and the fees for it all are really low.

I don’t know anything about Betterment so what follows is not a slap at them.

Some major index fund providers have gotten very serious about investment management for damn near everyone. Vanguard will manage your investments for 0.3% annually. I’m not sure about Schwab and Fidelity but it wouldn’t surprise me.

For certain, Vanguard works the same as you described. You develop the investment strategy with them, make your deposits on your schedule, and they do the rest.

Schwab Intelligent Portfolios are “free”, but they keep a large percentage in cash (which they get use of).

Its annoying, because it’s not like “real” cash – if you take some cash out for unexpected expenses, they’ll re-balance back to the cash position.

I can keep cash myself, thanks very much.

They’re also not aware of tax-advantaged vs. non-advantaged accounts, so the portfolio won’t place things ideally across multiple accounts.

Right but that applies to plans between $5k and $25k. I think the “loss” is de minimus at that level. At $25k you can exercise more control over your cash. If you have $120k or more in your account then their annual investment management fees are less than Vanguard.

Occasionally I think about playing around but….

I am the guy that never gambles. Ever. I don’t loan money without solid collateral. I have tried to be very careful with money since I learned how to handle it. I have done pretty well if I can brag a bit. I won’t ever really see any of it and I don’t mind. I fully expect Mrs. Suthenboy to outlive me and my goal all along was that she not have anything to worry about.

If I invest in anything it has to have a 99.9% chance of paying off.

Yeah, I’m with you on that. I lost about $20 in casinos in my adult life. Never understood the gambling thing. I lent about 2 grand to my brother when he was in a tight spot about 10 years ago and he paid me back within a year when he got back on his feet.

There’s something very comforting about going to bed at night and not having to worry about losing a job or a steep bill or other financial worry.

That is finally sinking in for my son. For his late teen and early 20’s years he want shiny things. Not long ago I pointed out that all of things are stacked up in his garage, rusty and covered with dust. “Wouldn’t you rather have the money?” drove the point home.

“You know what is better than having a new car? Not having a car payment. ” He hasn’t bought a new car since I pointed that out.

Yes, not having to worry about finances is very comforting. It is the single most effective stress reliever.

It really is. I had an ex freak out over a 3k bill that came out of nowhere. She couldn’t cover it despite making 80k a year and we had a low amount of monthly obligatory commitments. We had VERY different views on finances and it was one of the things that ultimately torpedoed the relationship. There’s no way I’d ever get in a relationship with a spender, it’s just not how I’m wired. I’m a tightwad and happy with it. I’m buying a house this week and, humble brag, I could pay cash for it. I’m not since life happens, but knowing I can cover the mortgage for a few years of unemployment makes cutting the downpayment check much more palatable.

I just re-financed and it was very soothing to think “I could just pay this off”.

I should thank my younger self for not spending too much on stupid shit. I have complaints for him (“that one girl? She was really interested in you, idiot.”), but at least he got that part right.

Congrats!

Thanks, you too!

Thanks! The house is more than a single guy needs, but I couldn’t find a 2bed/1bath detached house within 30 minutes of work that wasn’t in a shitty part of town. At least I have a garage where I can drink beer and pretend to work on my car.

I’m single and have 2400 sq ft, 3bed, 2,ba.

On a similar note, garage door is going in now. I just hire a guy who was cutting a tree down at my neighbor’s to do my tree. I’d usually cut a tree down myself, but it’s not too far from the power lines, and he only wants $250 (I have to cut it up myself, he’s just getting it down) It’s an expensive day for me.

I’m going to have to run the heat 8 full months of the year and can’t justify the cost to heat a lot of unused space. Even a wood stove would still cost money to run since I don’t have many trees on the property.

Very true. And this is what boggles me about the whole anti-wealth mindset that some people have.

Sure, money isn’t everything. I probably wouldn’t be very satisfied with my life if I had tons of money but no friends, family, passions, ambitions, or sense of belonging/importance.

But a lack of money will definitely make you unhappy and in fact suck the joy out of other things. By building up wealth, you are insulating yourself from that unhappiness. In addition, you’re opening up the door to things that will make your life more fulfilling – travel, hobbies, philanthropy, etc.

I used to hang out on an SEO/Internet marketing forum, and the people there had a very pro-wealth attitude. A saying I heard there was “Money isn’t everything, but I’d rather cry in a Ferrari.”

Money isn’t everything as you point out, but I like way the you frame it as insulation. I’m fortunate that I can give every year to my old college team, and bypass the administration, so that the current guys can have a better experience than my cohort did. Fortunately, my teammates also feel the same way and we support them generously.

I’ve heard Dave Ramsey put it this way: Money amplifies what was already there. If you were an asshole, you’ll be a raging asshole. If you were unhappy, you will be depressed. If you were generous, you will be philanthropic. If you were frugal, you will be responsible.

Another good one I heard somewhere: “Money doesn’t make you happy, but it makes it a hell of a lot easier”

How To Think About Money is sitting on my Kindle, next in queue. It covers much of this ground – the “why” of acquiring wealth.

I once told an employer , ” uneployment doesn’t scare me like it might scare some of your other employees”.

The best 3 months of my life were when I was unemployed. Granted, I had a severance during that time, but I still didn’t spend nearly anything. It doesn’t take much to keep me happy.

Strong power play.

watch what you say to someone with nothing it’s almost like having it all

FOX Sports coverage of baseball is insufferable. Why am I watching the London Series pregame? I have no one to blame but myself.

I’m glad I didn’t blow a pile of cash to go to London to watch the Sox stink up the place. Oy, what a start.

At least the cricket fans won’t be bored. 1/2 hour top of the first? This is gonna be a long-assed game.

Cricket fans got excited today: https://www.bbc.com/sport/cricket/48812583

Just schedule India vs Pakistan without extra security and be done with it.

Extra? Take away the nominal security too.

Let them resolve any issues themselves.

Sox making this interesting. Still in the 1st… You weren’t kidding about long-assed.

We’re on pace for a 9 hour game.

JFC. Now I’m going to have to watch this whole game.

I’m the epitome of buy high, sell low.

Sell? I just watch ’em go to zero.

Self-loathing attention whore

It may come as no surprise that a strong majority of Americans support a wealth tax — a higher tax rate for a small number of millionaires and billionaires.

But what might be a surprise is that some of those millionaires and billionaires are calling for a wealth tax themselves.

Abigail Disney is one of those people.

Whatever. Tell me about the day you realized you were an utter disappointment to your daddy.

I’m not sure there’s anything worse than being lectured about the need for higher taxes by someone who simply inherited their money.

People in my office praising diversity while ensuring they live in non-diverse neighborhoods and schools zoned accordingly also ranks up there.

People around here are big on diversity. The “looks different, thinks just like me” kind of diversity, mind you.

There is definitely something worse than being lectured on it. It’s worse when those assholes decide to run for office and act on it.

What a bunch of horseshit. Armies of accountants and lawyers to make sure they pay the least amount of taxes possible and calling for the punishment of success. All these assholes are doing it pointing the envious pitchfork and torch wielding crowd away from themselves.

My problem isn’t that they pay less, my problem is that they are working the envy crowd up to go after someone else.

She’s free to give me some of her money if she’s serious about things.

Narrator: “She wasn’t serious.”

If she wanted to do something with her life instead of just talking she could start the movement of billionaires and millionaires who self tax. Take 20, 30 percent of your wealth (or more! Give till it hurts.) and send a check to the US Treasury. They will accept it. Do it publicly and get other rich idiots to sign on.

I won’t be holding my breath to see that.

What’s the point of being rich without power???

1000x this.

And as we all know income taxes have a way of staying put and never creep down the brackets until your average middle class sucker is paying more, too.

And once again, I have to ask: why should the feds have more to spend, regardless of who’s paying for it?

Paul Krugman has literally argued that the goal of tax policy should be to raise as much money as possible for the government and that the rights of the wealthy should not be considered at all.

Yeah they want wealth taxes.

Their team of accountants will be moving that wealth out of the US so fast the air current will mess you hair do up.

Including Disney’s accountants – if called on it she’ll exclaim there’s nothing she can do as it’s just a trust.

“It may come as no surprise that a strong majority of Americans support a wealth tax”

No, it wouldn’t, because it’s pure bullshit. If it was actually true, then it would be a surprise.

How many times have you seen the video clips where they ask people on the street what percentage rich people should pay in taxes and they always say a percentage lower than it is already?

Here’s the world I want to live in: I want to live in a world that doesn’t need philanthropy. And if [Amazon CEO] Jeff Bezos earned less and paid his people more, and didn’t have $37 billion to put into a philanthropy and figure out what to do with [it], there really wouldn’t be that much philanthropy that was needed. I would rather not to be needed as a philanthropist, and I will never stop feeding the hungry and housing the homeless and all the other things that I want to do.

Private philanthropy is bad because all those government functionaries need something to do.

She wants to live in Brazil.

Hey now, the Save The Poor industry is very lucrative.

Wondering if any of the Glibs who are into crypto have a particular wallet that they like? I was researching a bit as I want to set up payments to my biz in crypto and also buy, sell and trade. Any recommendations?

My brother uses coinbase. At least he used to.

Thanks. Another one to check out.

(Still kicking myself for not buying Bitcoin seven years ago when I was thinking of doing so.)

My brother bought a couple of bitcoin years ago. He never spent it and has no idea what hard drive it’s stored on. He thinks it might have been on a flash drive he threw out. He doesn’t really seem to care to even check. Just a nonchalant “well i might still have it somewhere.” I really don’t understand it. I would check every memory device I have, twice to see if it was still somewhere. And it’s not like he’s rich. In fact, he’s unemployed right now, with little savings.

If he’s broke and owns two bits, todays exchange rate of $11,882.40…carry the one…

He might want to find it.

3.2? It is no Weihenstephaner Hefe, but that is crazy low.

WH is a 5/5 in my book.

I currently drinking a Georgetown ”Bodhizafa” IPA. Not too hoppy.

The juniper has kicked my ass. After all that dust and pollen, I feel like I’ve been punched in the face several times. I may just stand and stare at it today.

Recently, Facebook got in on the action by creating their own version of cryptocurrency, Libra, meant to assist people in countries that have difficulty accessing banks. This strikes me as odd, because if somebody lives in a country so poor that finding a bank to store money and process transactions for personal business is problematic, how is it that person has access to the internet with strong enough signal to process such a transaction?

Lots of places have mobile internet (and in India, Facebook even offered free mobile Internet access – one tied to Facebook – before government stomped on them) and cheap phones, while still having a population suspicious of banks or not needing full range of banking services. Yes, such places make other arrangements, but Facebook thinks it can leverage its size and goodwill to compete with less formal channels.

“There’s something very comforting about going to bed at night and not having to worry about losing a job or a steep bill or other financial worry.”

Amen. I have a wife in the advanced stages of Old Timers but the one worry I don’t have is the ability to financially pay for her care. My heart aches for those who are scrambling to pay bills while dealing with this situation.

Sorry to hear that, Spud.

Being childless, having enough to cover future medical situations is a big driver for me. Ain’t nobody going to take care of my wife or I except us (well, probably nobody – my nieces and nephews are great and all, but they’ll have lives of their own).

My plan is to be as big of a burden as possible until the day I die . . . Enough with all you people talk of personal responsibility. .this is America dammit!

That’s rough Spud. I feel for you man.

In terms of funds and diversification. Most of my retirement is through the TSP managed funds as well as a couple smaller work 401ks – I’ll try and roll both Fidelity and Voya accounts into a single account at my next job.

Curious if there are any real downsides to the “retirement date” funds – ie. targeted 2040 or something similar. I’m starting to use that one more in the TSP just because the timeframe and format seems to make sense (still also keeping a significant proportion in the index funds).

I use the targeted date in one fund. I don’t think there’s a downside, per se, since the fund will become more conservative as the target date and allows for more volatility and risk before the money is needed.

We always advise against target date funds as they are historic under performers, but you’ve got to be able to sleep at night, too.

Huh, good to know.

That said!

If you do really want to have one, they’re not terrible.. they just dont typically keep pace with inflation. If you want one because your other fund choices are too risky, then it’s absolutely the right choice because of your risk tolerance.

https://www.youtube.com/watch?v=GO0JaecRWy0

Those funds answer the wrong question: when will you retire. The correct question is allocation/diversification given your liquidity horizon.

If a business cycle is typically six years and you wish to retire in 2040, I can’t imagine managing your portfolio with a view to liquidity before 2028: two business cycles before you anticipate any liquidity needs at the earliest. Until then, it’s all about allocation; any other priority is taking your eye off the ball.

I had been avoiding Kingdom Come Deliverance because the description of the combat system made me go “That sounds really annoying”. Turns out, not only is it annoying, it’s clunky, and wonky to boot. It’s gotten to the point where I’ve been avoiding the main story missions not out of an effort to do side quests (I’ve been avoiding those too) but because those missions will involve more combat, and against larger groups of foes – which is even more obnoxious than single combat. Plus you can’t choose an alternative method for approaching the mission because they are literally “storm the enemy camp”. So the game has become “Herbalist Simulator 2018”.

There are two other things that drive me nuts in the game. First is the “Must lose boss fight” at the end of the prologue (one of the worst storytelling techniques that makes me dislike the game designer instead of the villain).

The second is the dog. It is nothing like a real dog in all the wrong ways. The one dog-like trait it shows is the tendency to rush right in front of your feet while you’re walking and trip you up – even if you’re sprinting away from it at full tilt. Second, because it does this, it is constantly in the way when trying to interact with anything on the ground (like herbs) or in combat. And it requires constant, incessant validation, or it gets even more obnoxious.

Why am I still playing this game?

Irritainment.

Because you still think it will be like this:

https://youtu.be/7w-atB68kpI

Where’s my fist bump MikeS?

Fuck YES!

Rock on

Old garage is dismantles. The new one is set to go in. The installer doesn’t understand how it’s supposed to fit. He says the estimator ordered a special door that wasn’t needed. He said he’ll make it work. I hope so, I don’t want to have to board up the garage until they have it figured out.

The tree guy’s chain saw just broke. But most of the tree is already down. I think his son is bringing him another saw.

Also, It feels really weird watching other people work and not offering to help. Every time I head the wood hit the ground from the tree I want to run out and help move it out of the way. Every time I hear the garage installers tools, my urge is to check and see if they need help. I’ve left them both alone for the most part, but it’s really not in my nature not to help.

Update: the tree is down. I’ll cut it up the rest of the way tomorrow.

The garage seems to be moving slower.

Update 2: Garage door itself is in. He’s doing something with spring now. Still needs: Motor, trim, outdoor keypad, indoor button, and sensor installed.

I’ve was toying with the idea of moving the sensor after install. Place them close together above the door so I can hit the button and walk out without jumping over the sensor. However, I figured that was a moot point since I can close it with one touch to the outdoor keypad.

Install a wicket in the garage door, so you don’t have to open the whole thing to leave.

Update 3: The garage motor drive can’t be installed because of the beam placement. A couple sections need re-framed. The garage door company won’t do that. So, I have to do it. they’ll come back in a couple weeks to complete the install, I’m not very happy. I voiced this exact concern to the estimator and he told me they’d find a way to make it work. The installer just told me he was let go earlier this week. Either way, I’m a aggravated. And, i get to do some framing this week in the 90+ humid weather in an external garage that acts like a an oven.

Let me guess, you paid in advance?

I’ve only paid half when i ordered. The other half is due upon completion. The installer was good about it. I don’t mind moving some of the framing, I just wish I knew before they came. I had time in the last two weeks to do it and the weather was great. Now, It’s hot and I’ve got several projects I need to do. Oh well, it happens.

That sucks big-time, man. The worst part is you can’t even yell at the idiot estimator. Shitty deal.

*dumps out a beer into my mouth for bangin’*

I’m off to a friends for his birthday, where I’ll dump several beers into my mouth, should make things a little better.

We had a similar situation with replacement windows. Estimator, “yeah, that’s a tricky one but, no problem our install guys are great.”

A month later, install guy “!” Wife: “so the estimator was just doing a sales job?” Installer, “yep, pretty much.”

I know exactly what you mean, I am the same way.

Solution: I go buy lunch for them. Around here that means a bacon double cheeseburger combo or a bucket of fried chicken. Every time I have done that I became their favorite customer.

Two things labourers and tradespeople of all stripes appreciate: food and tips. We just finished moving, and I probably spent $500.00 on tips and around $150.00 buying lunch for the guys on both ends of the trip. Possibly the best money I ever spent. There wasn’t anything these guys wouldn’t do for us.

Pro tip: always tip them at the start of the day, so they know you’re a tipper. After the work’s done it’s way too late. You want ’em in a good mood early.

Tips, sure. Food, depends. I appreciate the sentiment but I don’t like sweats and usually pack my lunch, so when homeowners show up with donuts or pizza or other fast food, I either have to eat some stuff I don’t want just to be polite or look like an ungrateful asshole. In other words, offer to get donuts or lunch just don’t show up with it, puts people in a spot.

I always ask what they want. Then I go fetch. Works well.

Same city as Walmart Pringle can wine lady was.

https://www.foxnews.com/us/texas-woman-banned-from-walmart-after-eating-half-a-cake-demanding-to-pay-half-price-only

Do they have a satisfaction guaranteed like some stores? If so, buy the whole thing. Eat half, get a full refund.

I just think it’s funny that she thought that would work?

I don’t understand why the Pringle-wine lady was banned. Did she steal the Pringles or the wine?

It’s because Cool Ranch Chardonnay is too uncouth even for Wal Mart.

I do not like witbiers, nor do the people around me. They don’t agree with my digestion and produce room-clearing results.

You sounds like a real gas to hang around.

Sounds like he has a bloated opinion of himself.

It really stinks to drink alone.

Oh blow it out your ass.

You guys are so funny when you’re just fartin’ around.

I agree – that statement didn’t pass the smell test.

There’s no need to get shitty with him tho.

Christ, what an asshole!

Taint that the truth.

Feature, not a bug.

FYTW.

https://townhall.com/tipsheet/bethbaumann/2019/06/29/federal-judge-delivers-massive-blow-to-trumps-border-wall-funding-n2549213

Under what jurisdiction does this district judge think he has that power?

The judge has made his decision, now let him enforce it.

When will Trump learn that only Democratic presidents get to build the wall?

I wonder what the Dems are going to say when their guy is in and activist judges on the other side of the fence start pulling this shit.

What a bunch of morons.

You lose to high school boys’ teams.

https://townhall.com/entertainment/cortneyobrien/2019/06/27/another-us-soccer-star-picks-fight-with-trump-n2549079

“what are you protesting?”

The lack of attention I was receiving.

[citation needed]

What, you haven’t seen the FEMA death camps for gays?

Those aren’t death camps, they’re human resource reprocessing centers.

Any other links to this?

https://www.bbc.com/sport/football/48792042

The BBC story doesn’t report any quotes from her about gay rights. Here’s one section:

Rapinoe said she “would encourage my team-mates” to follow her stance and not be “co-opted by an administration that doesn’t feel the same way and fight for the same things we fight for”.

So, you’re not fighting to win the world cup?

SLD: Trump should have stayed out of this but, that would be against his nature. From all the reporting, Rapinoe fired the first shot. But, shit, if I were prez, I would have just said, “meh, it’s an invitation, no one’s obligated to attend.”

She’s the best women’s soccer player. Talk about tallest midget. Women’s soccer is slightly more interesting than doing my taxes.

And I say this as a huge fan of the sport in general.

With the increased standard deduction, my taxes got less interesting. The numbers at the top of the screen never changed.

If I were on the team I’d tell her not to try to pressure me into believing her political views.

I’d tell her to shut the fuck up about politics to the media. But apparently she is unable to do that.

Isn’t she co-opting her teammates and coaches?

What I really wanted was the part about Wahl asking her for specifics, but all the regular news outlets seem to be ignoring that part.

https://www.youtube.com/watch?v=0kFWwGugo_M

7:15 mark

Thank you!

What a wuss! “I need a specific question.” Specific question is offered. “Umm, I think I just want to talk about the game.”

TBF: she just assumes everyone knows that Trump is bad without explanation.

I think this is the original interview: https://8by8mag.com/megan-rapinoe-visionary/

Oops.

https://www.miamiherald.com/news/local/crime/article231993167.html

Why does his mug shot have him looking like they dressed him in a Tyvek™ suit ?

Is that current jail fashion ?

It’s Florida

” At first, police believed she had overdosed on drugs, until an autopsy revealed she had been strangled.”

Remember kids, when doing BDSM while high as a kite, make sure to remember your safe word.

Obligatory sexbot news.

https://sputniknews.com/viral/201906291076099664-sex-machines-brothel-opinion/

*shakes head*

The very idea of a previously used sexbot just strikes me as wrong. And that’s what you’ll get if they’re deployed in brothels.

I have news for you about the human brothel employees…

I don’t do business with them either.

How is that different from actual prostitutes?

Actual vaginae are more or less self-cleaning.

Given enough time between creampies of course.

It’s more expensive to swap out parts to put unused genetalia in them?

Eh . . as long as they’re cleaned properly I don’t see that as an issue for me. My larger problem is that I don’t have any desire to have relations with a robot, especially for money.

Yea, robot sex would be weird. It’s basically just extremely convoluted masturbation.

And I think I’m a minority in this regard, but I never understood the appeal of sex with some random woman with whom you don’t actually have any relationship. I’ve done it before and found it quite unsatisfying.

Random sex isn’t bad to me, but sex within a relationship with someone you care about is always better. As heartless of a libertarian as I am, feelings do have a place in sex.

Strongly dependent on what the random woman looks like.

It’s all in your head(s).

Though if that name is accurate, the existing options might be even more terrifying.

“digisexual therapy”

Will Medicare for all pay for this?

Not at any rate that would make it possible to clean the machines.

I read it has the hooker weans you off of your digital/robot sex addiction.

Do you really want to be serviced by the whore who’ll take medicare reimbursement rates?

Ummm….

Whatever dood.

https://freebeacon.com/politics/playboy-heir-to-host-kamala-harris-fundraiser/

Does she really want to remind people how she got her job?

Too bad Hef didn’t leave that punk out of his will.

He just wants a Willie Brown Special.

“On Friday, the Supreme Court denied Alabama’s petition for appeal after federal courts blocked a 2016 law that would have banned late-term abortions, in which the baby is dismembered in the womb. The 11th Circuit Court of Appeals had noted that the procedure was indeed dismemberment, but the three-judge panel said it was bound by Supreme Court precedent established in Planned Parenthood v. Casey (1992) that prohibits any law placing an “undue burden” on abortion access.”

https://freebeacon.com/issues/supremes-decline-anti-dismemberment-law/

“Undue burden” meaning not dismembering.

Remember, if women can’t get their babies dismembered, then it means the US is exactly like the Handmaid’s Tale.

I’d give an arm and a leg to see the make it to SCOTUS.

So… a few hundred bucks?

For you guys or gals with the big bootie fetish.

https://www.foxnews.com/lifestyle/celebrities-reportedly-inspired-odd-wisdom-tooth-body-shape

“Personal trainer Ben West of 360 Athletic explains that these stars are likely going to great lengths to achieve the shapely look.”

“Great lengths” = Photoshop.

I do not find any of the kardashians attractive in the least bit. I do, however, respect their ability to separate people from their money in voluntary transactions.

Stupid thunder, terrifying my dog.

I’ll trade you, it’s 92, full sun, and humid as hell here. And I have to cut up a tree in this weather tomorrow.

I have one of the beer glasses in the photo at top. Wife brought it to me from Germany.

In more interesting news:

How much of your money are democrats willing to spend? This might give you some idea, or … all of it.

Gimme all your stuff!

“all of it, and then some”

I can see Bernie and the rest of his comrades on top of some building with bags full of worthless dollars, getting airlifted out of the country right before they get hung from lamp posts for bankrupting the country.

Only for the helos to run out of fuel and crash into the braying mob.

It’s not their money. What do they care how much they spend on buying votes? This really is how democracy dies.

It’s alright. An adjustment to the tax burdens of the 1% will pay for it all. Just ask Bernie.

Berntard just admitted that they WILL raise taxes on the middle class. He just hasn’t admitted how much yet. But Europe will give you a clue. Your taxes will get raised from around 20% to around 60%. IOW, forget about your home, your cars, or the other stuff you love, you can’t afford any of that.

Yep, it’ll be public transpo and filing cabinets for people from now on. Kinda like the Lower Mainland of British Columbia.

Learn from the error of my ways, people — do not move anywhere on the Left Coast. They’re all exactly the same crap.

My local beer bar has Schnieder beers on permanent taps. Their Hefe is pretty good. I like most German Hefe beers better than the Belgians.

I’m more fond of the Dunkleweizen.

Fredericksburg, Texas had tons of great German beer. I can’t remember for the obvious reason what I had, but the Dunkelweizen sounds familiar. It’s a great town and anyone who goes to Austin needs to take the day or overnight trip out there.

Right now it’s beer degrees Fahrenheit. What is that in Celsius?

The French Thermometer I have here reads “Surrender”

Gin & Tonic degrees

Oh, you have a commonwealth thermometer.

I do indeed my good sir.

The hell with that. Give me some Bundy.

Well played!

I have a pint stashed away somewhere in my packed up belongings. There’s no reason to start any fights, so it’s staying where it is for now.

Ted or Al?

Kelly, please.

Cliven.

Just finished replacing a spigot, which ended up being a bigger task than I anticipated.

They always do, Leon. Every single time. How many trips to hardware store?

3 Trips this time. Luckily I improved it this time. The previous owner had soldered the spigot directly to the copper pipe rather than install a female adapter. So after desoldering i installed an adapter so next time it won’t be so difficult. The trouble is i had no equipment for it or experience. But it always feels good to learn a new skill.

Ouch.

In HS I worked part time in a hardware store. The owner had some new plumbing installed and they sweated the lines and fixtures. Overnight a small spark smoldered in the wall and hours later caught fire. The place burned to the ground.

All of these decades later I am still scared to use any kind of open flame near an open wall. For that matter, no open flames in my house at all. Don’t bring candles here unless. you want to see me throw them down the hill.

Plumbing always is.

I consider a successful plumbing job to be 3 trips or less to the hardware store.

I always try and buy more fittings than I think I’ll need and return what I don’t use.

Did you have to sweat it or do you thankfully have something like Pex?

Unfortunately had to solder it, but i installed an adapter so next time it will be easier.

Sox down 17-6 in in the 6th – “screw this, I’ll watch Patriot while I row”.

A quick 30 minutes later, and it’s now 17-13. This fuggin game.

So they scored a touchdown?

I think they just said this is now higher-scoring than the NFL games they’ve had in London

Dang. Uruguay v Peru 4 – 5. Sad Uruguay lost but it seems like it was quite the match.

Umm, 5-4 on penalties.

Oh it was penalties? usually they report those separately from the goals scored in game

Yikes. Ugly storm coming. I hope there’s better weather behind it.

We are all staring out the windows enjoying our favorite activity – watching the mad dash of bathers fleeing the beach when the rain starts.

And it’s so windy, all of our front porch plants have been knocked over.

Hit us around 4 pm. Sunny out now and I’m heating up the grill.

It must be the day of DIY. I repaired my busted shock and mount, same for the other side, and rotated the tires. Saved at least $200 on labor.

Must be…My lazy ass finally got the carburetor changed on the tractor this morning.

I’ve been fixing plugs and switches at the new place since we moved in. All Decora-style stuff, now. Good thing, too we discovered that there were some problems with a few of the switches and receptacles which could’ve caused fires if they hadn’t been addressed. If I’d hired an electrician to do all of this, I would’ve been into the guy for a couple of grand, minimum.

ground pin up or down ?

Y’mean my re-install? Depends on the location — up if there’s a chance of dropping a metal tool or implement, down otherwise.

I mentioned some of the handyman jobs y’all have been talking about to the wife and she started with the same thing I have heard a thousand times. “You always look at those jobs and say you can do it in an hour then you spend half of the day cussing and spitting and throwing tools. When are you going to realize you aren’t 30 years old? We need to just hire someone to do that stuff.”

I think she is right, but thank y’all for letting me know it isn’t just me.

The job did take an hour. The cussing and throwing tools was just for fun.

I took a nap today.

#metwo and by that I mean I took two naps today

#metoo

Took out a bunch of dead limbs from the big pine.

Republicans do LSD too. Fake lede.

https://hotair.com/archives/2019/06/29/republicans-donating-marianne-williamson/

That is funny. Get the opposition party to put up the nuttiest nut they have and given their lineup that is saying a lot.

Free pussy crystals for all would be an interesting plank.

Democrats donated to Trump in the Republican primary so he would have a better shot.

The joke was on them.

A squirrel was sitting on my porch watching me mount a scope onto my 10/22. I wonder if it is going to have nightmares.

Now off to the range to zero it in.